Pages

- Accueil

- OPZIONI FACILI GANN

- GANN OPTIONS SECRETS

- ELLIOT-WAVE

- GANN SECRETS

- FIBONACCI

- INVESTIRE CON LE TECNICHE DI GANN

- CANDLESTICK PATTERNS

- Dax Technical Analysis

- Elliottwave-Forecast

- GANN CHART

- DAX Outlook

- WD Gann’s Angles

- METAL REPORT

- GOLD REPORT

- Forex gann calculator

- FOREX SYSTEM

- IMPORTANT

- Pivot Point Definition

samedi 30 mai 2020

jeudi 28 mai 2020

Stocks: What to Make of the Day-Trading Frenzy

By Elliott Wave International

Day trading - it's back.As you'll probably recall, day trading became so popular during the late 1990s that some market participants were selling their homes to raise the funds to participate.

It didn't end well. After peaking in March 2000, the NASDAQ went on to lose 78% of its value.

Yet, even after the dot.com bust, day trading never went away. There was a marked resurgence in the months leading up to the 2007 stock market top. But, even then, day trading activity was not as intense as it was around the time of the dot.com bubble.

However, the wild speculation that was taking place around the time of the February 2020 top did call to mind the 1990s.

The March Elliott Wave Financial Forecast, a monthly publication which covers major U.S. financial markets, the economy and cultural trends, showed this chart and said:

mercredi 27 mai 2020

Vibration is fundamental; nothing is exempt from this law; it is

universal, therefore applicable to every class of phenomena on the

globe…. After years of patient study I have proven to my entire

satisfaction, as well as dem-onstrated to others, that vibration

explains every possible phase and condition of the market” (Ticker

interview).

mardi 26 mai 2020

lundi 25 mai 2020

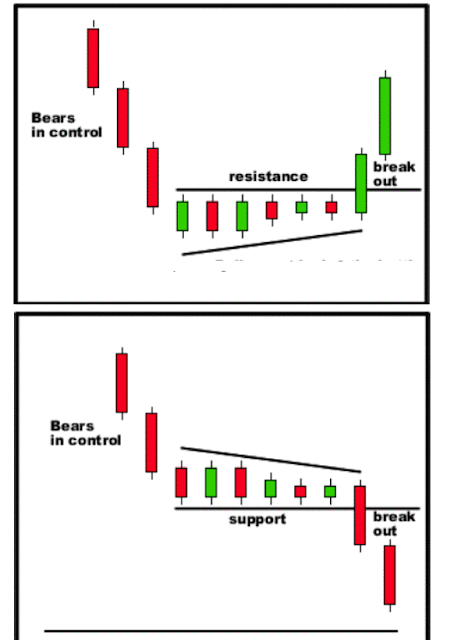

Why Bear-Market Rallies Are So Tricky

By Elliott Wave International

Many stock market investors believe that prices have already bottomed. Numerous banks, brokers and financial firms have issued statements saying as much.Indeed, the May Elliott Wave Theorist, a monthly publication which has offered analysis of financial and social trends since 1979, noted:

On April 28, Bloomberg interviewed four

money managers to answer the question of "Where to Invest $1 Million

Right Now." Cash was not mentioned.

All these professional financial observers might be right in their assessment that the bottom is in for stocks.Then again, the stock market rise since the March 23 low might be a bear-market rally.

If so, it certainly has "done its job," meaning, as one of our global analysts put it in Elliott Wave International's May Global Market Perspective (a monthly publication which covers 40+ worldwide markets):

vendredi 22 mai 2020

jeudi 21 mai 2020

mercredi 20 mai 2020

mardi 19 mai 2020

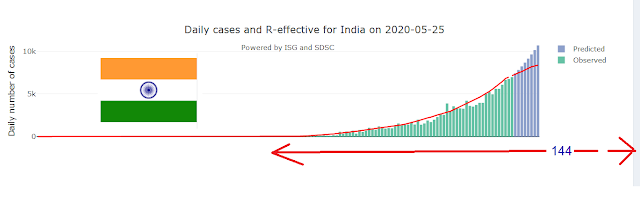

An Eye-Opening Perspective: Emerging Markets and Epidemics

People across the entire planet remain very much aware of the COVID-19 health threat.

The global disruption associated with the pandemic far surpasses other major health scares in modern history.

Even so, you may recall 2009 news articles similar to this one from the New York Times (June 11, 2009):

The global disruption associated with the pandemic far surpasses other major health scares in modern history.

Even so, you may recall 2009 news articles similar to this one from the New York Times (June 11, 2009):

It came as no surprise [on June 11, 2009]

when the World Health Organization declares that the swine flu outbreak

had become a pandemic.

The disease has reached 74 countries ... .

dimanche 17 mai 2020

samedi 16 mai 2020

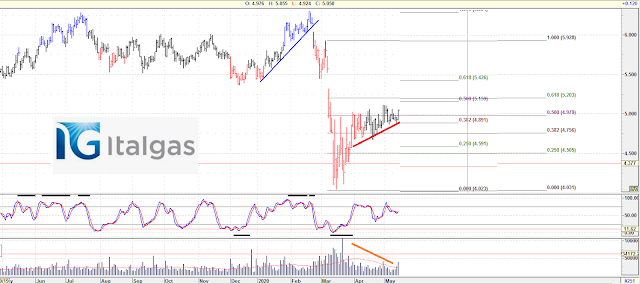

ANALISI TECNICA TITOLO ENEL

ANALISI TITOLO ENEL CANDLESTICK

il titolo si sta mantendo sotto la trendline rossa finche resta sotto è probabile che completa una discesa

con un onda 5 anche solo per un doppio minimo

inversamente una risalita sopra la trendline in accordo con lo stop del segnale candle produrrà un segnale di acquisto con un primo targhet di 7.5 e un ulteriore di 8 euro

Inscription à :

Commentaires (Atom)