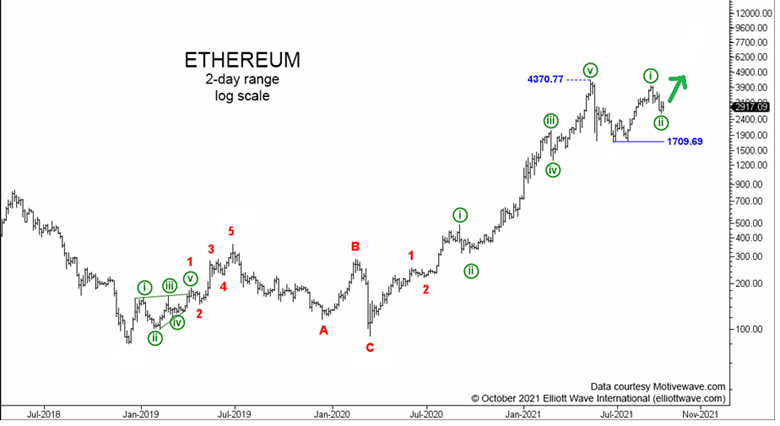

Here's what happened after the completion of a "bullish triangle"

By Elliott Wave International

A Charles Schwab survey shows that 15% of today's retail investors started investing in 2020.

And, regarding 2021, an August 2 CNBC headline said:

New investors are jumping into the market

So, when you combine the influx from this year and last, that adds up to a lot of new investors.

This is mentioned because some people who are new to investing may see the phrase "emerging markets" and get the impression that this is synonymous with only small countries.

Yet, "emerging markets" covers 75% of the world's population, and are comprised of nations like China, India, Russia, Brazil, South Korea, Thailand, Taiwan, Malaysia and more.

All told, emerging markets account for about a third of global GDP.

The point being -- new and veteran investors alike should at least have emerging markets on their radar screen for consideration. Yes, there's risk, yet there's also opportunity.

Consider a classic Elliott wave pattern in the Vanguard FTSE Emerging Markets ETF.

The April 2020 Global Market Perspective, a monthly Elliott Wave International publication which covers 50+ worldwide financial markets, said:

Largest emerging markets ETF completes bullish triangle.

Of course, the completion of that bullish triangle implied that the next price move would be up.

That's exactly what happened. Here's a current chart from Mark Galasiewski, an Elliott Wave International global analyst who focuses on the Asian-Pacific: