The Fed’s September lowering of the fed funds rate was greeted with widespread celebration on Wall Street. Yet, history shows that such moves by the Fed don’t always translate into a glowing economy. Elliott Wave International's October Financial Forecast provides perspective:

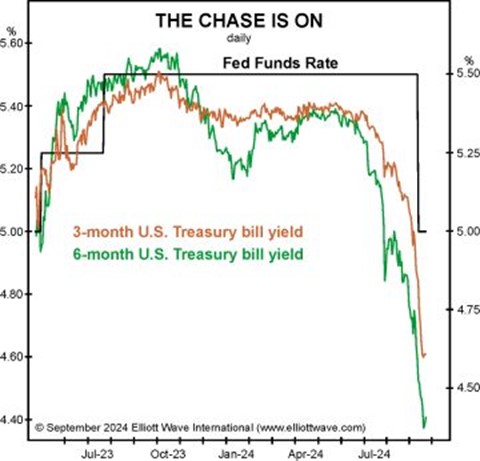

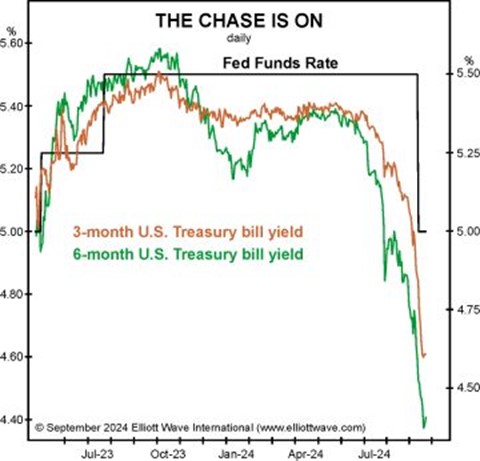

The August 2 issue forecast the Federal Reserve’s “approaching rate cut,” saying “the Fed will lower the fed funds rate commensurately with the lower level of T-bills.” On September 18, the Fed announced a 50-basis-point drop in the Fed Funds rate from 5.5% to 5.0%. By that time, the yield on the 3-month U.S. T-bill had slipped to 4.75%, and the yield on the 6-month U.S. T-bill was 4.50%. This week, the yields have declined to 4.61% and 4.40% respectively. So, the Fed Funds rate is still lagging the decline in market rates.

|

More important, the popularity of the Fed’s “decision” continues to mushroom. In August, Financial Forecast discussed “the positive vibe surrounding” the potential rate cut, saying that it “simply confirms that a bigger peak foreshadows an even bigger economic contraction.” The cut itself stoked the optimism. “50 bps…I will take it…BIG!” tweeted one of Wall Street’s biggest TV commentators. On CNBC, a well-known investment banker “lauded the Federal Reserve for creating ‘nearly perfect’ economic conditions.” Soaring hopes are a classic setup for the surprising failure called for in the August issue. At that time, we noted that it should be a repeat of September 2007’s initial Fed-Funds rate cut, which came three months before the start of the Great Recession. As we also illustrated then, the Fed was behind the curve the whole way, cutting rates continually into the final quarter of the contraction. This time, the effect of a turn toward negative social mood will be greater.

When will social mood go from positive to negative? And what will that mean for major U.S. financial markets like stocks? Tap into all the insights of EWI's Financial Forecast and Elliott Wave Theorist at a special combo price by following this link.

Aucun commentaire:

Enregistrer un commentaire