Il FTSE MIB ha chiuso mercoledì in calo dello 0,2% circa a 33.089,7, il minimo da metà agosto, estendendo le perdite per il terzo giorno. Gli investitori hanno continuato a valutare le implicazioni per l'Europa delle politiche tariffarie promesse dal presidente eletto Donald Trump, nonché le incertezze sulla

stabilità dell'esecutivo francese. Gli operatori si sono concentrati anche sulle prospettive della politica della BCE. Il membro del Consiglio direttivo della BCE Isabel Schnabel ha sottolineato l'importanza di un approccio graduale ai tassi di interesse. Tra i singoli titoli, i principali perdenti sono stati STMicroelectronics (-2,3%), Generali (-2,2%), Iveco Group (-1%) e Nexi (-0,8%). Nel frattempo, Banco BPM (+1,1%) è stato sotto i riflettori dopo il rifiuto dell'offerta di UniCredit (-0,2%), e anche MPS (+3,2%) ha guadagnato attenzione in seguito alle nuove speculazioni sul consolidamento bancario.

**********************************************

FREE | $99 Value | November 19-29 | elliottwave.com

While everyone searches for the Holy Grail of forecasting, which does not exist, there is one method of analysis that stands apart from the slew of momentum-based indicators, all of which by definition lag the market. The Elliott Wave Principle is based on the concept that crowd behavior is patterned and that these patterns are easily discerned in the prices of freely traded markets. This alone sets it apart in the world of technical analysis.

1. Identifies Dominant Trend in Any Timeframe

The Wave Principle identifies the direction of the dominant trend in any timeframe. A five-wave advance on a daily chart identifies the dominant trend as up on a daily basis. Looking at the same instrument on an hourly chart might reveal that the dominant trend on an hourly basis is down within the larger daily chart timeframe.

2. Identifies a Countertrend Move

The Wave Principle also identifies countertrend moves. The three-wave pattern is a corrective response to the preceding five-wave pattern. Knowing that a near-term move in price is merely a correction within a larger uptrend is valuable information.

3. Identifies the Maturity of a Trend

Elliott catalogued a finite number of patterns to which the markets adhere. Once a pattern is over, it's over. For example, if prices are advancing in the fifth wave of a five-wave advance, and the fifth wave has already completed four of its subwaves, one more subwave is all that is required to complete the pattern, which, by definition, will lead to a change of trend.

4. Identifies Price Targets

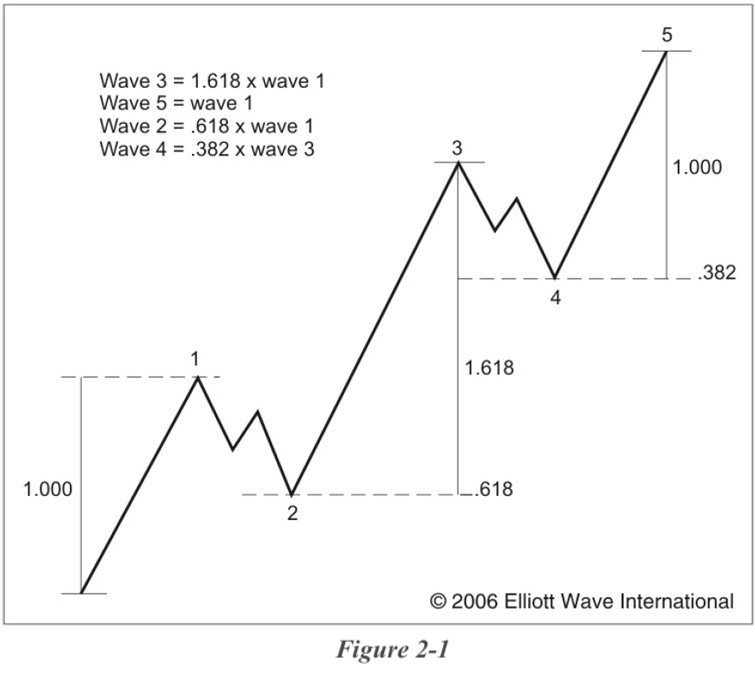

The Wave Principle also provides price targets based on common pattern relationships. When R.N. Elliott wrote about the Wave Principle in Nature's Law, he stated that the Fibonacci sequence was the mathematical basis for the Wave Principle. Elliott waves, both impulsive and corrective, frequently adhere to Fibonacci proportions, as illustrated in Figure 2-1.

5. Identifies Context

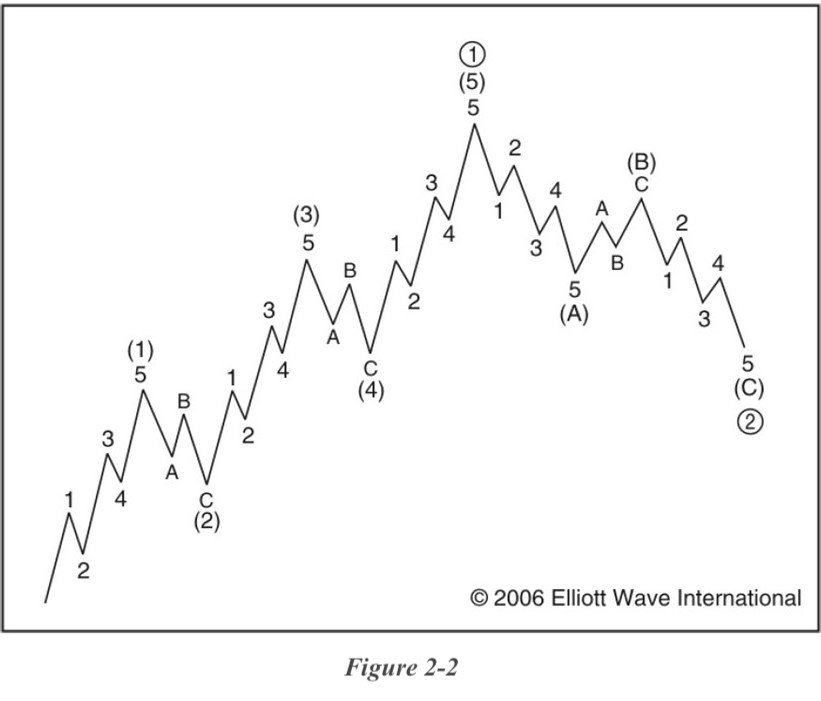

Perhaps most important, Elliott observed that wave patterns form larger and smaller versions of themselves. This repetition in form means that price activity is fractal, as illustrated in Figure 2-2. Wave (1) subdivides into five smaller waves yet is part of a larger five wave pattern. This process is occurring at every degree, all the time, and is the key to understanding what market probabilities are next.

Free thru Nov. 29 only — Watch Elliott Wave International's popular trading course Why Wave Analysis Belongs in Every Trader's Toolbox. EWI lead analyst Favio Poci teaches you the 5 core wave patterns, how to spot high-confidence setups, where to set your entry/exit points and more. It's a $99 value, yours free thru Friday, Nov. 29. Get your free trading course now >>

https://www.elliottwave.com/landing/why-wave-analysis-belongs-in-every-traders-toolbox/?utm_medium=aff&utm_campaign=cr-toolbox&utm_content=benefits&utm_term=affar&utm_source=16gs&acn=16gs&rcn=166aa&dy=aa112724

Aucun commentaire:

Enregistrer un commentaire