Elliott Wave International’s new, free report examines current market metrics to expose just how over-owned, over-loved & over-valued stocks are right now. You owe it to yourself to read this today.

Check out the opening analysis and chart:

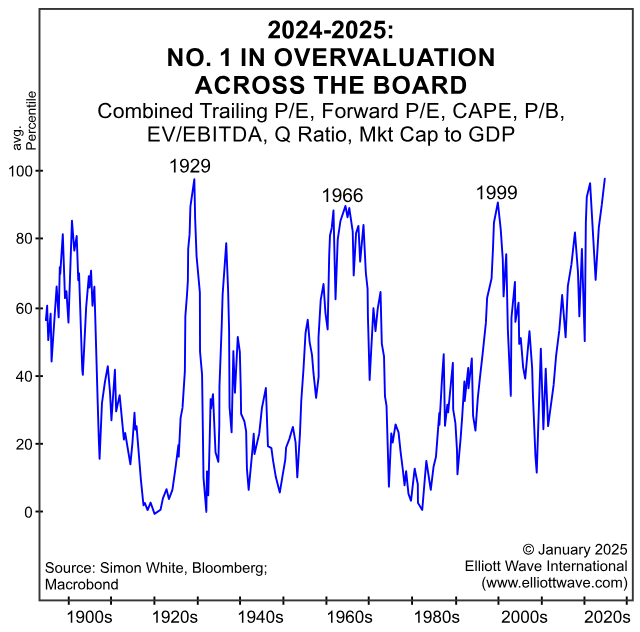

“Bloomberg's Simon White describes investors' position within the stock market this way: ‘Everyone is long,’ and many are now willing to pay unprecedented amounts of money for any type of financial performance. In fact, with the chart below, White illustrates that the last two times that key valuation metrics were as stretched as they are now, in 1929 and 1999, the stock market reversed course and declined dramatically. The graph combines various measures of valuations and financial performance such as trailing earnings, anticipated earnings, book value, sales, replacement costs and market capitalization. The latest iteration of these combined ratios produced the all-time high shown on the right side of this chart. This is yet another among dozens of indications that...”

|

Aucun commentaire:

Enregistrer un commentaire